Investor Psychology to Drive Gold Prices Higher

Going into 2018, if you are not looking at gold prices closely, you could be making a big mistake. The yellow precious metal could see a solid move to the upside. An increase of 17.77% could be possible this year.

Why?

You see, it’s important to understand investor psychology.

Investors tend to buy assets that are increasing in value. It’s the fear of missing out—commonly referred to as “FOMO”—that forces them to buy. Rarely do they buy assets selling at rock-bottom prices.

For example, look at Bitcoin. It wasn’t until mid-2017 that investors started to care about it. Prior to then, the cryptocurrency was relatively ignored and sold at a severely low value. But, as its price started to move higher, everyone wanted to own it.

With stocks, we see the same: investors are rushing to buy stocks these days as key stock indices are at their all-time highs. If you go back to 2009, no one wanted to own stocks.

Now, coming back to the yellow precious metal, gold prices increased in 2016 and 2017. This happened on the back of severe pessimism toward precious metals.

With this, don’t be shocked if there’s a sort of FOMO event in the gold market in 2018. Investors could be rushing toward the metal because there’s already some momentum to the upside built into it.

Also, over the past few months, big banks have really started to come on side with gold. We see a lot of them bullish on gold in 2018 and beyond. So, this could give investors further confidence.

Where Are Gold Prices Headed in 2018?

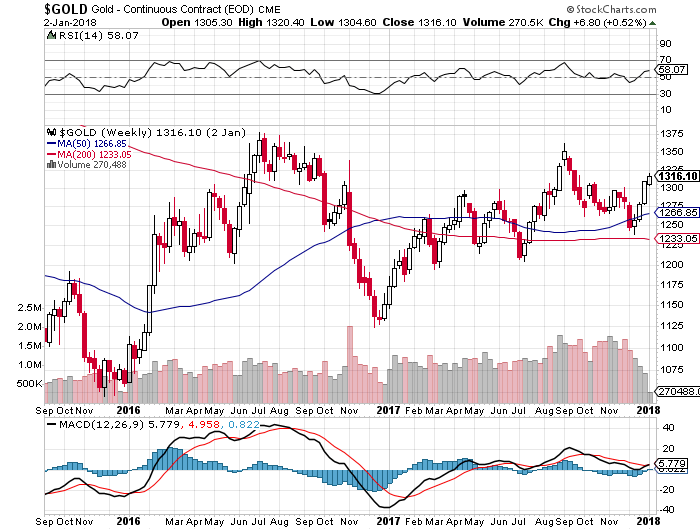

Looking from a technical analysis perspective, gold prices could be posting solid gains in 2018. Please look at the chart below.

Chart courtesy of StockCharts.com

On the chart above, you want to pay attention to three big developments:

- Gold prices trade above their 50-week and 200-week moving averages. This says the intermediate-term trend and the long-term trend are pointing upward and there’s bullish sentiment toward the yellow precious metal.

- Pay attention to the momentum indicator at the bottom of the chart, the moving average convergence/divergence (MACD). Notice how the red line is about to cross over the black line on the MACD? Technical analysts call this a “buy” signal. Also, the momentum indicator continues to suggest that buyers are present and they could be taking gold prices higher.

- On the upside, there’s a lot of resistance between $1,350 and $1,375. If gold prices are able to break above this level, the next big resistance isn’t until the $1,500-to-$1,550 area.

What Should Investors Do?

Dear reader, it currently looks like all the bases are loaded for a rally in gold prices.

With this said, it’s important to pay attention to gold mining companies. If the yellow precious metal makes a run toward $1,550 in 2018 (roughly 17.77% above the current price), we could see massive gains among gold mining companies. It wouldn’t be shocking to see a few of them double or more on this small increase in price.